Corporate Governance Report

Corporate Governance Report

1. Basic Policy on Corporate Governance

The Company considers its important mission is to implementing a corporate philosophy of "We pursue innovation at the foundations of our society that creates unique value, driven by respect for humanity and relationships of trust." in order to sincerely fulfill its social responsibility, be widely trusted by society and aim for sustainable improvement of corporate value.

Based on this philosophy, we use our business activities to build positive relationships with all our stakeholders, and engage in responsive, efficient, sound, fair and transparent business. To this end, we introduce new measures as necessary, such as the strengthening of our management supervisory functions and provision of information disclosure.

2. Overview of Corporate Governance System and Reasons for Adopting the System

The Company has in place an audit & supervisory board system.

ⅰ) Board of Directors

Our Board of Directors has five members (including three external directors) as of the filing date. As a rule, the Board of Directors meets regularly once each month and otherwise as deemed necessary. The Board of Directors makes decisions on basic management policy and important managerial matters, and makes efforts to strengthen business execution oversight. A director's term of office is one year to enable quick response to changes in the business climate and to clarify directors' management responsibilities in each fiscal year. An executive officer system was also introduced to promote timely decision-making and smooth business executions.

During the fiscal year under review, the Board of Directors met 18 times, and discussed and deliberated on important managerial matters, such as basic management policies, sustainability, corporate governance and M&A. In addition to the above-mentioned meetings held, there was one written resolution that was deemed to be a resolution of the Board of Directors.

Attendance by individual directors is as follows:

| Position | Name | Number of meetings held | Number of meetings attended |

|---|---|---|---|

| Representative Director, Chairman, President and Chief Executive Officer (Chairperson) | Tadahiko Konoike | 18 | 18 |

| Director and Senior Managing Executive Officer | Tadatsugu Konoike | 18 | 18 |

| External Director | Yoshihito Ota | 18 | 18 |

| External Director | Mika Masuyama | 18 | 18 |

| External Director | Taisuke Fujita | 18 | 18 |

ⅱ) Audit & Supervisory Board

The Company has adopted a system of audit & supervisory board members. The Audit & Supervisory Board consists of four members, two of whom are external members. To bolster our corporate audit structure, we established the Audit & Supervisory Board following resolution of the 68th Annual General Meeting of Shareholders held on June 25, 2008. As a rule, the Audit & Supervisory Board meets once monthly as one measure to strengthen management functions.

ⅲ) Personnel and Remuneration Committee

At a meeting of the Board of Directors held on June 26, 2019, the Company resolved to establish a Personnel and Remuneration Committee as an optional advisory body to the Board of Directors for the purposes of reinforcing the autonomy and objectivity of activities by the Board of Directors concerning nominations of the directors, Audit & Supervisory Board Members and executive officers, and remuneration of the directors and executive officers. During the fiscal year under review, the Personnel and Remuneration Committee met 9 times as advised by the Board of Directors to discuss and report on the nomination and remuneration of directors, executive officers, etc. It has been judged that the independence and objectivity of the Personnel and Remuneration Committee has been ensured because an independent external director serves as Chair, while the ratio of independent external directors has remained at half as it comprises two independent external directors, one external director, and one internal director for a total of four members.

Attendance by committee members is as follows:

| Position | Name | Number of meetings held | Number of meetings attended |

|---|---|---|---|

| External Director (Chair) | Mika Masuyama | 9 | 9 |

| Representative Director, Chairman, President and Chief Executive Officer | Tadahiko Konoike | 9 | 9 |

| External Director | Yoshihito Ota | 9 | 9 |

| External Director | Taisuke Fujita | 9 | 9 |

The Company is adopting the current system in the belief that it will be possible to ensure transparency and efficiency in management by implementing the above initiatives.

3. Other Matters Regarding Corporate Governance

Basic Policies

The Company defines its Corporate Philosophy as "We pursue innovation at the foundations of our society that creates unique value, driven by respect for humanity and relationships of trust." and sets forth the following basic guidelines in relation to the establishment of a system for ensuring proper operations of the Company and the Company's subsidiaries (hereinafter the "KONOIKE Group") pursuant to the Companies Act and the Regulation for Enforcement of the Companies Act.

(1) Framework for initiatives to operate and improve the internal control systems

Aiming to ensure the properness, validity and efficiency of the KONOIKE Group's operations and to continually improve corporate value, the Company shall set up an “Integration Committee” for promoting the maintenance, construction and operation of the management systems that accompany business activities.

In addition, the Company shall set up the following subcommittees under the organizational structure of the Integration Committee: Internal Control Subcommittee, Risk Management Subcommittee, Information Security Subcommittee, Compliance Subcommittee and Environment Subcommittee.

(2) System to ensure that directors and employees execute their duties in compliance with laws and regulations and the Articles of Incorporation

- (ⅰ) Based on the Corporate Philosophy of "respect for humanity and relationships of trust" and Business Principles, the Company shall establish the "Regulations on Corporate Ethics" to ensure that the execution of business by officers and employees complies with laws and regulations and the Articles of Incorporation.

- (ⅱ) To ensure thorough compliance with the "Regulations on Corporate Ethics" and its practical operations, the Company shall conduct education and training of officers and employees, and also develop systems by such means as establishing the "Operational Regulations on the KONOIKE Helpline" and accordingly setting up the KONOIKE Helpline (the "Helpline") with access available both inside and outside the Company.

- (ⅲ) The Company shall establish the "Compliance Regulations," set up the Compliance Subcommittee, and take steps to build and promote the KONOIKE Group's compliance system. One (1) outside expert shall be included in the members of the Compliance Subcommittee.

- (ⅳ) The internal audit sector shall be tasked with performing internal audits on the properness of operations of officers and employees, and reporting the results to representative directors and Audit & Supervisory Board Members.

- (ⅴ) The Company shall endeavor to develop a system for severing relations with antisocial forces that pose a threat to public social order and safety, and for explicitly rejecting improper demands.

(3) System for retention and management of information pertaining to execution of duties by directors

- (ⅰ) Respective sectors in charge shall properly retain and manage documents such as minutes pertaining to duties of directors and other such information in accordance with the "Document Management Regulations" and other internal regulations.

- (ⅱ) Directors and Audit & Supervisory Board Members may access such information at any time.

- (ⅲ) The Company shall engage in proper operations for handling, safekeeping and ensuring security of information. To that end, the Company shall develop the "Basic Policy on Information Security" and the "Regulations on Information Security Management," and set up the Information Security Subcommittee to ensure thorough management of information.

(4) Regulations and other systems for managing risk of loss

- (ⅰ) The Company shall take steps to develop and construct systems for risk management. To that end, on the basis of the "Risk Management Regulations," the Company shall establish a basic policy and system for managing business risks, set up the Risk Management Subcommittee, and continuously carry out activities to prevent and constrain emergences of risks that could cause damage to corporate value and occurrences of crisis situations.

- (ⅱ) The Risk Management Subcommittee groups business risks into the three categories of: 1. business continuity risk, 2. asset integrity risk, and 3. business operation risk, sets two management levels (Company-wide risk and sector-level risk), and carries out proper risk management according to these categories and management levels.

- (ⅲ) The Company shall develop a crisis response manual and formulate "Crisis Management Standards" in relation to the "Business Continuity Plan" (BCP) and build a system that enables continuance of operations even in the event of a large disaster or accident, an incident involving impropriety, or other contingencies, and swift recovery and resumption of operations.

(5) System to ensure that directors execute their duties efficiently

- (ⅰ) To ensure that directors efficiently execute their duties, the Board of Directors shall rationally allocate duties of directors and appropriately appoint executive officers.

- (ⅱ) In principle, the Board of Directors shall hold meetings each month where, in accordance with the "Rules on the Board of Directors," participants discuss and make decisions on important matters of management, based on principles of business judgment and the obligation to act with due care of a good manager, and the status of executing duties and others shall be periodically reported. Moreover, the Company shall establish the "Management Meeting Regulations," and accordingly set up the Management Meeting which is subordinate to the Board of Directors and meets periodically.

- (ⅲ) The Company shall track results of medium-term management plans and fiscal year budgets formed at a meeting of the Board of Directors, on a monthly and quarterly basis, thereby verifying progress toward achieving such objectives and reviewing respective plans and budgets.

(6) System to ensure the properness of operations within the Corporate Group comprising the Company and its subsidiaries

- (ⅰ) System for reporting to the Company on matters regarding execution of duties by directors and others of subsidiaries

- The "Regulations on Management of Subsidiaries and Associates" shall stipulate rules on information sharing between the Company and its subsidiaries and for reporting on operations, and require periodic reporting to the Company regarding subsidiary operating results, financial status and other material information.

- Monthly debriefing sessions managed by each division shall be periodically held. Those attending shall strive to share important management information, and subsidiaries shall be required to report as necessary to the Company's Board of Directors or the Company's directors in cases where a material event has occurred at the subsidiary.

- (ⅱ) Regulations and other systems for managing risk of loss at subsidiaries

- The Company shall formulate the "Risk Management Regulations" used throughout the KONOIKE Group, designate departments or sections responsible for addressing respective risks in these regulations, and manage risk of the entire KONOIKE Group extensively and comprehensively.

- The Risk Management Subcommittee set up within the Company shall act as a body that oversees risk management for the KONOIKE Group. In that capacity, it shall discuss issues and measures pertaining to promotion of risk management across the entire KONOIKE Group.

- To prepare for contingencies and crisis situations, the KONOIKE Group shall develop a crisis response manual and formulate "Crisis Management Standards" in relation to the "Business Continuity Plan" (BCP) covering the entire KONOIKE Group, and widely disseminate it to KONOIKE Group officers and employees, as well as take steps to facilitate smooth business continuity throughout the KONOIKE Group.

- (ⅲ) System to ensure that directors and others of subsidiaries execute their duties efficiently

- The KONOIKE Group shall engage in business operations in accordance with duty allocation and authority explicitly set forth by internal regulations of respective companies, and take steps to bring about greater specialization and sophistication of operations through a system for effective division of labor. Through the system, it shall be allowed to delegate authority for duties according to level of importance, while improving agility of decision-making procedures.

- The Company shall formulate medium-term management plans and fiscal year budgets covering the entire KONOIKE Group. Formulating such plans and budgets shall involve work of compiling details using a proper combination of top-down efforts from management, and bottom-up efforts from the business sector.

- The Company shall strive to improve the efficiency of the execution of duties through the appropriate progress management of the medium-term management plans and fiscal year budgets that have been formulated.

- (ⅳ) System to ensure that directors, other executives and employees of subsidiaries execute their duties in compliance with laws and regulations and the Articles of Incorporation

- The Company shall establish the "Regulations on Corporate Ethics" and prepare the "Management Quality Handbook," which will be widely disseminated to all officers and employees of the KONOIKE Group.

- The Company shall endeavor to assign audit & supervisory board members and compliance promotion officers to respective companies of the KONOIKE Group, in numbers appropriate to the size, type of business and other attributes of such companies.

- The Company shall provide officers and employees of the KONOIKE Group with periodic training on matters such as legal and regulatory compliance, and take steps to foster awareness of compliance issues.

- The Company's Internal Audit Office shall conduct annual internal audits of respective KONOIKE Group companies, on the basis of the "Regulations on Internal Audits" and the "Regulations on Management of Subsidiaries and Associates."

- The Company shall set up and operate the Helpline which can be accessed by respective KONOIKE Group companies.

- Each overseas operating base of the KONOIKE Group shall secure business partners with whom they may seek consultation and advice as necessary on matters of local law, accounting and tax practices, in their efforts to develop and operate compliance systems.

- Respective KONOIKE Group companies shall endeavor to develop systems for the exclusion of any relationship with antisocial forces, on the basis of the "Basic Policy for Preventing Damage Caused by Antisocial Forces."

(7) Matters in regard to ensuring that employees who are to assist duties of Audit & Supervisory Board Members remain independent of directors, and ensuring that directions provided to such employees are effective

- (ⅰ) The Company shall ensure Audit & Supervisory Board Members are provided with assistance for their duties. To that end, the Company shall establish the Department of Audit & Supervisory Board Members under Audit & Supervisory Board, and assign employees tasked solely with assisting Audit & Supervisory Board Member with his or her duties to the Department of Audit & Supervisory Board Members at all times.

- (ⅱ) The Company shall seek the opinion of Audit & Supervisory Board Members when making personnel decisions regarding Audit & Supervisory Board Member assistants.

- (ⅲ) The Company shall specify rights to give instructions and orders to employees who assist Audit & Supervisory Board Member in the "Audit & Supervisory Board Members' Auditing Standards."

(8) System for reporting to the Company's Audit & Supervisory Board Members

- (ⅰ) Officers and employees of the KONOIKE Group shall report promptly and appropriately when the Company's Audit & Supervisory Board Members ask them to report on matters relating to execution of business.

- (ⅱ) The Company's officers and employees shall report to the Company's Audit & Supervisory Board Members or Audit & Supervisory Board immediately if they discover any violation of laws or regulations, or if they otherwise become aware of a development that could cause significant damage to the Company or any subsidiary of the Company.

- (ⅲ) Respective oversight departments or sections responsible for the Company's internal control, internal audits, compliance and risk management shall report to the Company's Audit & Supervisory Board Members on the status of matters such as internal control, internal audits, compliance and risk management of the KONOIKE Group, periodically or when necessary, as appropriate and without delay.

- (ⅳ) The department or section overseeing the Helpline in the KONOIKE Group shall periodically report to the Company's Audit & Supervisory Board Member regarding the status of whistleblowing by KONOIKE Group officers and employees.

(9) System to ensure that whistleblowers are not subject to disadvantageous treatment for reporting matters to Audit & Supervisory Board Members

- (ⅰ) In the "Audit & Supervisory Board Members' Auditing Standards," the Company shall prohibit disadvantageous treatment of KONOIKE Group officers or employees for reporting a matter to a KONOIKE Group's Audit & Supervisory Board Member, and widely disseminate the rule to KONOIKE Group officers and employees.

- (ⅱ) On the basis of the "Operational Regulations on the KONOIKE Helpline," the department or section overseeing the Helpline shall promptly report relevant details of whistleblowing to an Audit & Supervisory Board Member of the Company if they receive a report from a KONOIKE Group officer or employee either pertaining to a material development involving the violation of laws or regulations, the Articles of Incorporation or internal regulations, or otherwise pertaining to a material issue involving compliance. Moreover, the Company shall explicitly prohibit any dismissal or other disadvantageous treatment of individuals only for such whistleblowing.

(10) Matters concerning policies related to procedures for advance payment or redemption of expenses relevant to the execution Audit & Supervisory Board Member duties, or other accounting of expenses or liabilities incurred in connection with such execution of duties, and systems to ensure that Audit & Supervisory Board Members perform audits effectively

- (ⅰ) The Company shall promptly handle expenses and liabilities such that have been incurred by an Audit & Supervisory Board Member in executing his or her duties, in cases where a request is made to the Company such as for advance payment of expenses in accordance with Article 388 of the Companies Act, and whereby, after deliberations at the department or section responsible, except for the case where it is deemed that the expense or liability pertaining to such request is clearly not necessary for the Audit & Supervisory Board Member to execute his or her duties.

- (ⅱ) The Company shall cover expenses in cases where a request is made by the Audit & Supervisory Board to bring in an independent outside expert such as an attorney at law or certified public accountant to act as an advisor to an Audit & Supervisory Board Member, except for the case where it is deemed that doing so is clearly not necessary for the Audit & Supervisory Board Member to execute his or her duties.

- (ⅲ) The Company shall set a fixed annual budget for defraying expenses and other outlays incurred in the execution of Audit & Supervisory Board Members' duties.

- (ⅳ) Audit & Supervisory Board Members shall ensure audit effectiveness by endeavoring to maintain a liaison with the Internal Audit Office and the accounting auditor, taking part in periodic meetings, holding briefings for mutually presenting audit findings, and sharing information as necessary.

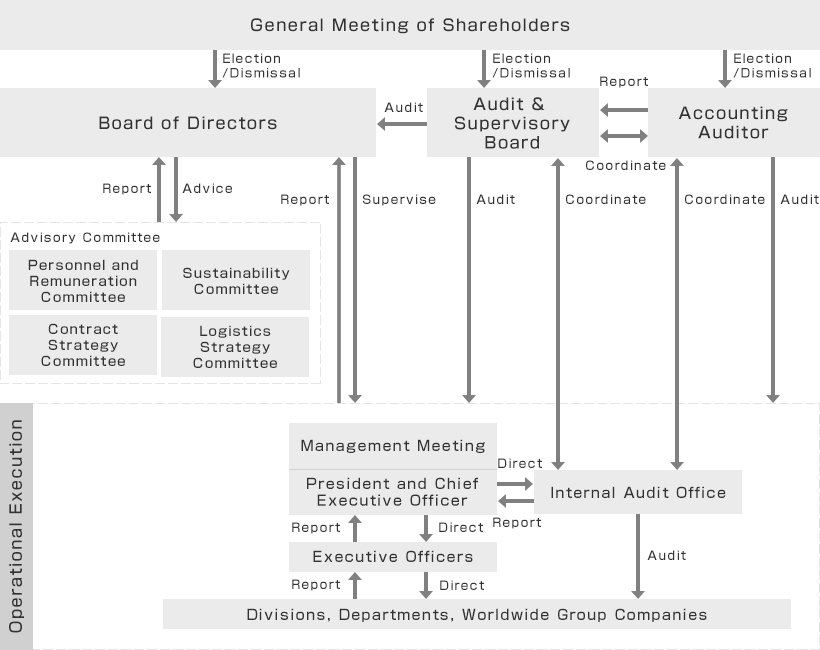

The Company's governance bodies and internal control, etc. are outlined below.

4. Status of Development and Improvement of Risk Management System

In order to achieve sustainable growth while responding to changes in the business environment, the Company has established a system that promotes examination, etc. into the analysis and preventive measures related to risk at each department or section for the various risks that accompany corporate activities. This system requires the efforts of the respective director in charge to work via the responding department or section to, as required, formulate rules and guidelines, organize training, and formulate and distribute manuals. Also, the Company has established the Compliance Department as the office in charge of survey, research, guidance and assistance carried out to fulfill the Company's social responsibilities. Furthermore, concerning inquiries relating to violations of legal compliance at an organizational or individual level, the Company has worked toward building an even stronger legal compliance system by establishing a system related to reporting to Audit & Supervisory Board Members, and internal reporting (whistleblowing) contact points setup inside the Group (dedicated office called KONOIKE Helpline) or outside the Group (a law firm that offers the Company legal counsel).

When legal issues arise, there is a system in place whereby the Company enters into a legal counsel agreement with the attorney providing legal counsel to enable the Company to receive the necessary guidance and advice from this legal counsel to provide appropriate responses.

5. Number of Directors

The Company states in its Articles of Incorporation that it shall have no more than 10 directors.

6. Resolution Requirements for Election and Dismissal of Directors

The Company states in its Articles of Incorporation that resolutions on the election of directors shall be made by a majority of the votes of the shareholders present at the meeting where the shareholders holding at least one-third of the voting rights of the shareholders entitled to exercise their votes at such meetings are present. The Company also states in its Articles of Incorporation that cumulative voting shall not be used for the election of directors by cumulative voting.

7. Overview of Details of Limited Liability Agreement

The Company has amended the Articles of Incorporation establishing provisions regarding limited liability agreements twice: once concerning external Audit & Supervisor Board Members at the Annual General Meeting of Shareholders held on June 25, 2008, and once concerning external directors at the Annual General Meeting of Shareholders held on June 22, 2010.

(1) Limited Liability Agreements with External Directors

Pursuant to Article 427, paragraph 1 of the Companies Act, the Company has entered into agreements with external directors to limit their liability for damages under Article 423, paragraph 1 of the same act. The maximum amount of liability for damages under these agreements is the minimum liability amount provided for under laws and regulations. Such limitation of liability shall apply only when the external directors acted in good faith and without gross negligence in performing the duties giving rise to liabilities.

(2) Limited Liability Agreements with External Audit & Supervisory Board Members

Pursuant to Article 427, paragraph 1 of the Companies Act, the Company has entered into agreements with external Audit & Supervisory Board Members to limit their liability for damages under Article 423, paragraph 1 of the same act. The maximum amount of liability for damages under these agreements is the minimum liability amount provided for under laws and regulations. Such limitation of liability shall apply only when the external Audit & Supervisory Board Members acted in good faith and without gross negligence in performing the duties giving rise to liabilities.

8. Overview, Etc. of Details of Indemnity Agreement

The Company has concluded an indemnity agreement with directors and Audit & Supervisory Board Members as provided for in Article 430-2, paragraph 1 of the Companies Act, and the Company shall compensate for the expenses set forth in item 1 of the same paragraph and the losses set forth in item 2 of the same paragraph within the scope prescribed by laws and regulations. Measures will be in place to prevent the appropriateness of a corporate officer's execution of duties from being impaired by the said agreement, such as not covering damages in the event that there is malicious intent or serious negligence in the execution of duties by corporate officers.

9. Overview of Contents of Directors and Officers Liability Insurance Contract

The Company has entered into a directors and officers liability insurance contract with an insurance company as stipulated in Article 430-3, paragraph 1 of the Companies Act, naming the Company's directors, Audit & Supervisory Board Members, and executive officers (including those who were in office during the fiscal year under review) as insured, as stipulated in Article 430-3, paragraph 1 of the Companies Act. The Company bears all insurance premiums.

The overview of the insurance contract is that the insurance company will cover the damages that may arise due to the insured officers being held liable for the execution of their duties or being subjected to claims related to the pursuit of such liability, and that the contract is renewed every year.

The insurance contract excludes cases in which the Company pursues compensation for damages against the officer in question, and the Company has taken measures to ensure that the appropriateness of the execution of duties by the officer in question is not impaired, by setting a limit on the amount to be covered.

10. Matters to be Decided by the Board of Directors Without Referral to General Meeting of Shareholders

To make a flexible return of profits to shareholders, the Company states in its Articles of Incorporation that except as otherwise provided by laws and regulations, the Company shall decide on matters provided in each item of Article 459, paragraph 1 of the Companies Act by resolutions of the Board of Directors, but not by resolutions of the General Meeting of Shareholders. Giving the Board of Directors the authority to decide on dividends of surplus, etc. is intended to realize flexibility regarding the return of profits to shareholders.

11. Requirements for Special Resolutions of the General Meeting of Shareholders

As a requirement for special resolutions at the General Meeting of Shareholders provided for in Article 309, paragraph 2 of the Companies Act, the Articles of Incorporation of the Company stipulate that such resolutions shall be made by at least two-thirds of the votes of the shareholders present at the meeting where the shareholders holding at least one-third of the voting rights of the shareholders entitled to exercise their votes at the meeting are present. The purpose of this is to facilitate smooth conduct at the General Meetings of Shareholders by providing an easier quorum requirement for special resolutions at those General Meetings of Shareholders.